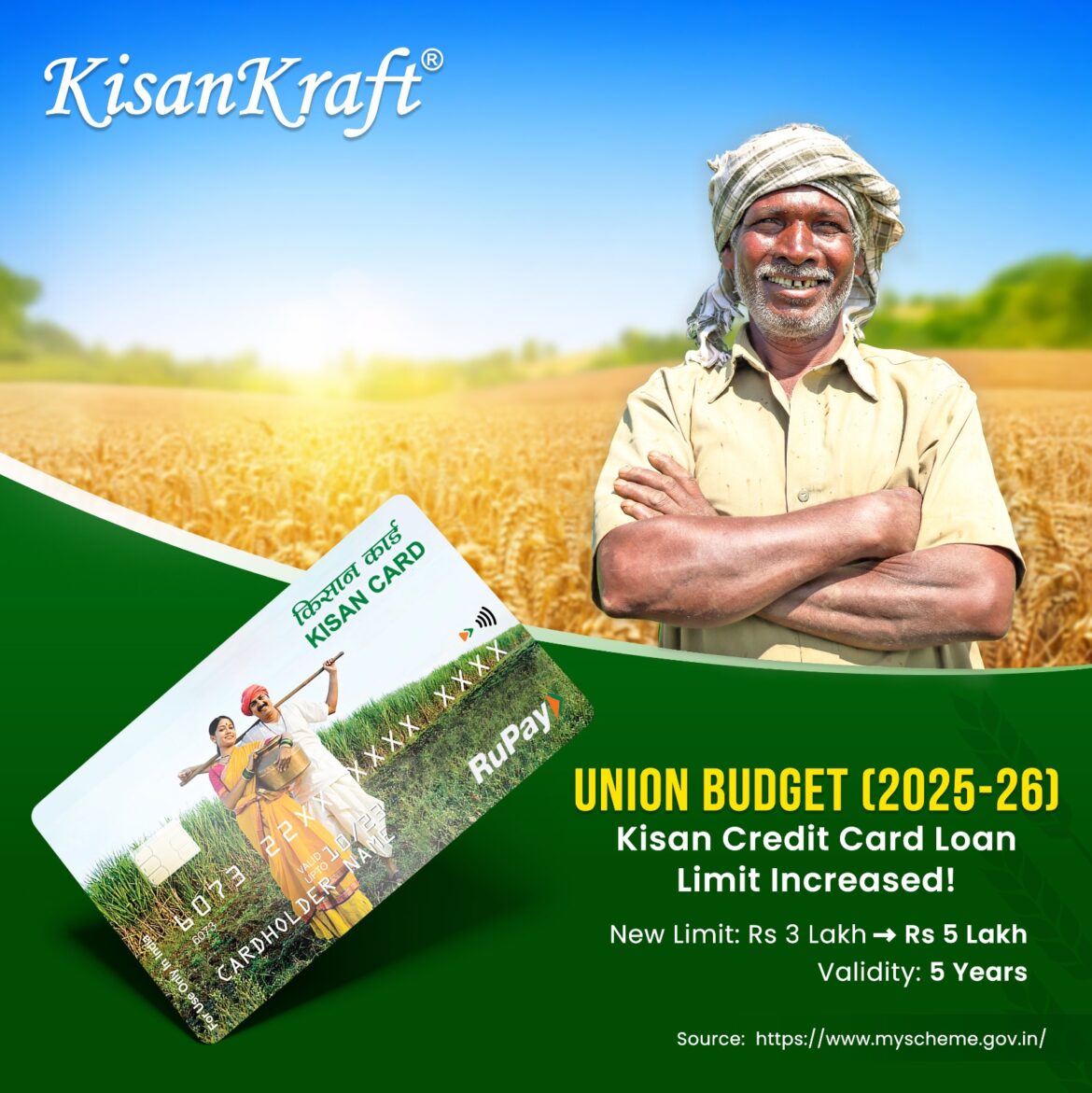

Budget 2025-26: Kisan Credit Card Increased Loan Limit & Extended Reach for Farmers

What is the Kisan Credit Card (KCC)?

The Kisan Credit Card (KCC) scheme, launched in 1998, provides short-term loans to farmers at subsidized rates, aimed at enhancing access to funds for farming activities such as buying seeds and equipment.

As of March 2024, the Kisan Credit Card (KCC) scheme had 7.75 crore active accounts, with a total outstanding loan amount of ₹9.81 lakh crore, reflecting its significant role in supporting farmers’ financial needs.

This growth underscores the importance of the KCC scheme in facilitating access to credit for agriculture and allied activities. As a result, the KCC has become an important financial tool for farmers to meet their agricultural needs. (4) (5), (6) , (7)

Budget 2025-26

In Budget 2025, Union Finance Minister Nirmala Sitharaman announced a significant increase in the loan limit under the Kisan Credit Card scheme. The limit will rise from Rs 3 lakh to Rs 5 lakh. This change will enable farmers to meet their expanding financial needs for farming operations. (8)

How Does the Kisan Credit Card Work?

The KCC works as a magnetic stripe card, equipped with a Personal Identification Number (PIN) and an International Identification Number (IIN). Farmers can easily withdraw funds from ATMs and micro-ATMs, making it more convenient to access credit when needed. Under the revised interest subsidy program, farmers can now access loans of up to ₹5 lakh, compared to the previous scheme which had a maximum loan limit of ₹3 lakh with a 5-year term. (9)

Recent Changes in the KCC Scheme

Budget 2025: One of the major changes is the extension of the scheme to 7.7 crore farmers. This expansion will allow more farmers, especially those with small landholdings or those in allied activities like animal husbandry and fisheries, to benefit from formal financial assistance. (10), (11)

Expanding Reach: 10 million More Farmers to Benefit

Budget 2025 focuses on expanding the reach of the KCC scheme to an additional 10 million farmers. This initiative will help underserved farmers access credit and receive much-needed financial support.

Under the KCC scheme, loans up to Rs 3 lakh are offered at a concessional interest rate of 7%. Moreover, farmers who repay their loans on time can benefit from a 3% interest subsidy, effectively reducing the interest rate to 4%. Loans above Rs 3 lakh, however, will be subject to interest rates determined by the individual banks’ policies. (12)

Documents Required for KCC Application

Farmers need to submit the following documents to apply for a Kisan Credit Card:

- Application form

- Passport-sized photographs

- Identity proof (Aadhar, Passport, Voter ID)

- Address proof (Aadhar, Voter ID)

- Proof of landholding

- Security documents for loans above Rs 1.60 lakh (13)

How to Apply for the Kisan Credit Card

Farmers can apply for a Kisan Credit Card by visiting their nearest bank branch. Some banks also offer biometric-based or RuPay-compliant cards for seamless transactions, making it easier for farmers to access funds. (14) , (15)

Empowering Farmers for a Stronger Agricultural Sector

Kisan Credit Card (KCC) scheme continues to empower Indian farmers by improving access to timely, affordable credit. With an increased loan limit and extended coverage, the initiative will support agricultural growth, reduce financial stress, and boost productivity. As a result, the KCC remains an essential tool for enhancing farmers’ financial stability and improving farming operations.(16)

Follow us for more information.